All Categories

Featured

Table of Contents

You don't require to be recognized to attach Fundrise, and you definitely don't require to spend a minimum of $25,000. Individuals can start spending on Fundrise with as low as $10, though you will require a much higher account balance to access some of the much more exclusive deals.

You're surrendering a little bit of control in terms of picking and handling property investments, yet that could be a good idea for investors that don't have the moment or knowledge to do the due persistance that Fundrise executes in your place. Low/flexible account minimums. Low charges, even compared to similar services.

Allows you invest in actual estate funds, not specific properties No control over exactly how funds are handled or exactly how properties are acquired. Investment takes time to pay off.

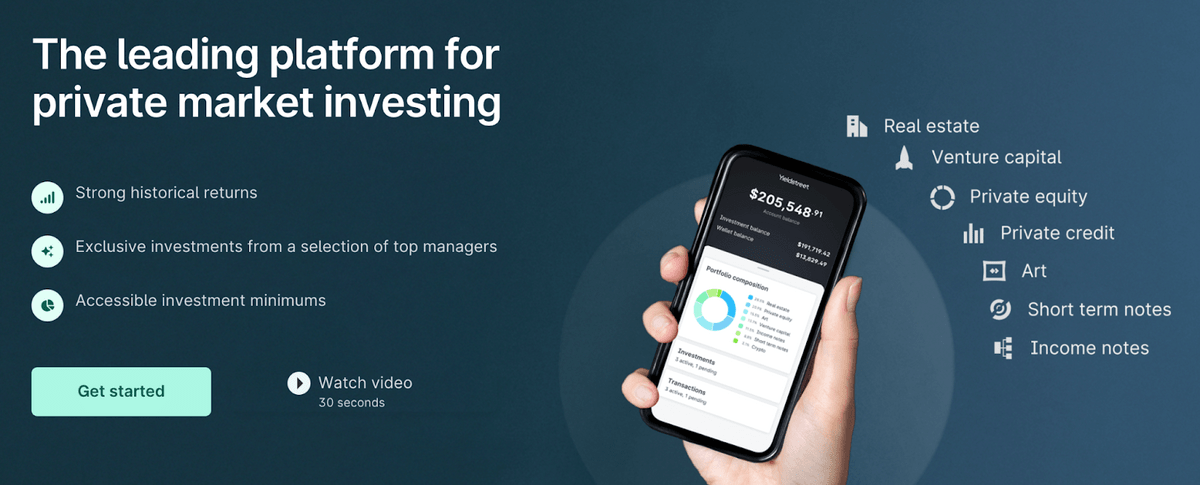

A great variety of deals is available with various returns and schedules. Development and Earnings REIT and Prism Fund are offered to unaccredited capitalists. Must be approved to buy many opportunities. Deals are well-vetted yet still risky. High minimum investment thresholds. $10,000 Development and Earnings REIT and YieldStreet Prism Fund; Varies for other investments0 2.5% annual management fees; Added fees vary by investmentREITs, funds, realty, art, and various other alternative investmentsVaries by financial investment DiversyFund is just one of the very best genuine estate investment apps as it provides unaccredited investors the chance to obtain as near route realty financial investments as the law enables.

What is the best way to compare Accredited Investor Commercial Real Estate Deals options?

The user friendly application offers capitalists the chance to obtain in on the activity. While you do require to be certified to participate a few of their premium chances, DiversyFund does not need accreditation to acquire into their slate of REITs and exclusive property investments. The financial investments they offer aren't as fluid as stocks, bonds, or many other things you'll discover on the bigger marketand purchasing in locks you in for a variety of years before you can sellbut their consistent returns and secure evaluations make them an optimal way to expand your tool- to long-term holdings.

Their application is built from scratch to make purchasing actual estate feel seamless and user-friendly. Everything from the spending user interface to the auto-invest function is made easily of usage in mind, and the care they take into creating the app beams through every tap. Incidentally, if you're fascinated by the idea of living in a part of your investment home and leasing the remainder, home hacking is a strategy you may intend to check out.

Easy-to-use application makes investing and tracking financial investments straightforward. The auto-invest function allows you schedule automatic payments to your investment. Just one kind of underlying possession. The largest offers call for certification. Rather limited impact (only 12 existing multifamily assets). $500 Development REITs; $25,000 Premier Opportunity Fund (approved); $50,000 Premier Direct SPVs (accredited) Differs based upon investmentREITs, multifamily residences, private real estate 5 7 years EquityMultiple has this very self-explanatory quote on their home web page from Nerdwallet: "EquityMultiple blends crowdfunding with a much more conventional actual estate spending technique that can bring about high returns." And though we would have quit at "approach" for the sake of brevity, the Nerdwallet quote sums up EquityMultiple's overall principles quite perfectly.

How can I secure Real Estate Crowdfunding For Accredited Investors quickly?

Wide variety of investment opportunities readily available. Certification is needed for all financial investments. Most chances have high minimal financial investments.

Lots of people aren't certified investors, so it adheres to that many people do not have five or six numbers worth of unspent funding just lying around. Once more, the majority of the services listed right here do call for significant minimum financial investments, however not all of them. Investing shouldn't be the sole province of the rich, so we consciously included solutions that don't call for vehicle loan-sized minimum financial investments.

No one likes costs, so it's just natural that you 'd wish to stay clear of paying huge administrative charges or annual service charge. That claimed, companies require to make money in some way. If they aren't charging you at the very least something for their time and effort, after that they're practically definitely being paid by the individuals whose financial investment opportunities they exist.

What is the most popular Real Estate Investment Funds For Accredited Investors option in 2024?

We wish to advise services that have your ideal rate of interests in mind, not the passions of the investment masterminds. This set is also easy and was more of a nice-to-have than a necessity. At the end of the day, the majority of the property spending apps out there are basically REITs that private capitalists can get into, so we do not expect them to have a big number of financial investments on offer.

Ultimately, we offered some consideration to the advised or needed size of time for each service's investments. Actual estate returns are measured in years, not weeks or months, yet we didn't intend to advise anything that would lock your cash up for a years or more. Was this short article practical? Many thanks for your comments!.

Some include alternatives available for non-accredited financiers, however examine the list to recognize for sure., complied with by even more comprehensive descriptions of each one: PlatformClass vs.

As an investor, financier'll be participating in getting involved purchase and acquisition of working farmland. As it transforms out, farmland has actually verified to be a great long-lasting financial investment.

While it's unfortunate for consumers, farmland investors stand to gain. Your investment will give both rewards paid out of the net rental revenue of the farm residential or commercial property, as well as capital gains upon disposition of the ranch.

What is a simple explanation of Exclusive Real Estate Crowdfunding Platforms For Accredited Investors?

$1,000 is the requirement for the Prism Fund and temporary notes. Individual offerings require $5,000. Specific offerings allow you to pick the details possessions you'll buy. For instance, you can buy different real estate bargains, like single-family homes or multiunit apartment. You can likewise buy excellent art, commercial aircraft leasing, new industrial ships, industrial funding, and even lawful offerings.

There is no monitoring fee, and the average holding duration is 3 months. Yieldstreet can also fit IRA accounts making use of a self-directed IRA (SDIRA), and their administration charge of 1% to 2% each year is really competitive. Short-term notes have no administration charge at all. Review our our Yieldstreet evaluation for a much deeper study the platform.

Table of Contents

Latest Posts

Unpaid Property Taxes Near Me

Tax Foreclosed Property

Free Tax Lien Lists

More

Latest Posts

Unpaid Property Taxes Near Me

Tax Foreclosed Property

Free Tax Lien Lists